In an ode to Portlandia this week, Nick and Rick discuss food and in particular, the increase in food costs that have clearly outpaced wage growth this year. What does this mean to overall demand in the economy and is it a portend of broader inflation and interest rates? Listen to the discussion and determine for yourself what the implications are of the price of that free range, all natural chicken you just bought at the grocer.

Chart of the Week: Small Cap Underperformance

Chart of the Week: The Investor Behavior Penalty

Chart of the Week: Sequence of Return Risk - Timing Matters

In this weeks installment, we discuss the implications of the sequence of risk to returns and how they can translate to dramatically different results in the portfolio over time. Learn how restraint from the shiny object syndrome and a focus on undervalued equities can be the key differentiators to ensuring you are properly hedged for risk, in whichever sequence risk is encountered.

Chart of the Week: Dry Powder - Why Now More Than Ever

2014 Q2 Commentary: Everything Changes ... Eventually

As recently as 10 million years ago, the Amazon river actually flowed east to west. At the base of the northern Andes, it formed a large lake that eventually flowed into the Caribbean Sea. Over time, it reversed course as the continent tilted and sediment built up. If the largest river on the planet can change directions - couldn’t the stock market?

Chart of the Week: Midpoint 2014 - Investor Complacency

In this week's chart review on margin debt in the NYSE and S&P, Nick discusses the implications of investor complacency in the equities markets and why this is something to pay attention to. We also refer to an earlier COTW discussion on the Perils of Prediction with regard to returns which is relevant to this week's discussion.

Chart of the Week: Investing - It Pays to be Nimble

Chart of the Week: Corporate Profits - Why Do We Care

Chart of the Week: YTD Bond Returns - The Perils of Prediction

Rarely is our attention captured by a short term chart, however, in the following from Bloomberg it illustrates the significant appreciation in long term Treasury bonds since the beginning of the year. Not only was this unanticipated, but the opposite was the prediction from most experts. Validity of predictions aside, it does beg the question what should be done with positions that are long on bonds? Listen to the following discussion and hear what Pilot's Portfolio Manager, Nick Fisher, has to say.

5/20/14 Chart of the Week: Not All Markets Are Overvalued

If valuations actually matter anymore, and the U.S. is in fact overvalued - then what do we want to buy? This week we look at cyclically adjusted price-to-earnings ratios (CAPE) of other foreign markets and the returns that they generate. Fittingly, we also discuss the difference between risk, volatility, and the permanent loss of capital.

5/13/14 Chart of the Week: Cov-lite and Why We're Lightening Up

Cov-lite lending and commercial loans have grown quite a bit in the last couple of years. This week, we discuss what covenant light commercial loans are, how they are made, and how the risk is mitigated by lenders. All of this of course informs our risk vs. return assumptions and the evolution of our fixed income allocations.

5/7/14 Chart of the Week: For Entertainment Purposes Only

You can find a chart that will tell you whatever you want it to: here are a couple that we will do very little with. Pascal is famous for the saying, "All of man’s misfortune comes from one thing, which is not knowing how to sit quietly in a room." And so while we are aware of some past trends, activity for activities sake is dangerous and stupid in our mind. We will wait for a bit of volatility. And be entertained along the way.

4/29/14 Chart of the Week: The Gamble of Quantitative Easing

With the Fed meeting later this week and the prospect of continued tapering of asset purchases, it is a good time to revisit the theory behind Quantitative Easing. In this extended discussion, we look at the impact of QE, the hope of what it will induce, and how we are planning for the uncertainty. We refer back to our 2013 Q3 Commentary and the capital markets line in the proverbial quest of answering the question of "what do we want to own?"

2014 Q1 Commentary: A Bird in the Hand is Worth...

We have written in last quarter’s report that we should expect lower annual market returns than what were achieved in the previous 4 years. The reason for this has less to do with a change in the vigor, (or lack thereof) with which our economy grows and more to do with the price paid for assets in today’s environment. To explain let’s first review the rationale of any capital allocation decision and finish with discussing the significance of volatility and the need for unconventional thinking. The basis of any capital allocation decision has not changed since Aesop’s truism in 600 B.C., “a bird in the hand is worth two in the bush.” Warren Buffett, in his letter to shareholders in 2000, added three questions to this enduring axiom: 1) How certain are you that there are indeed birds in the bush? 2) When will they emerge and how many will there be? 3) What is the risk-free interest rate [how would your bird in hand grow without taking any risk]? Of course, in Buffett’s example birds are dollars and a bush is any capital outlay or investment. If you can answer these three questions with certainty, than you will know the maximum value of the bush (investment) and the maximum number of birds (dollars) that should be offered for it.

4/22/14 Chart of the Week: The Game of Earnings Estimates

Earning estimates at the end of Q1 are much different than they were back in January. This week we explore how they have evolved over the last three months. The goal is to provide context for the proverbial headlines of "Company X beat estimates by $0.05 per share" that we are sure to hear.

4/15/14 Chart of the Week: Yesterday's Losers and Today's Winners

The rising tide does not raise all boats. In this week's conversation, Nick Fisher addresses the rotation from last year's losers into Q1's all stars.

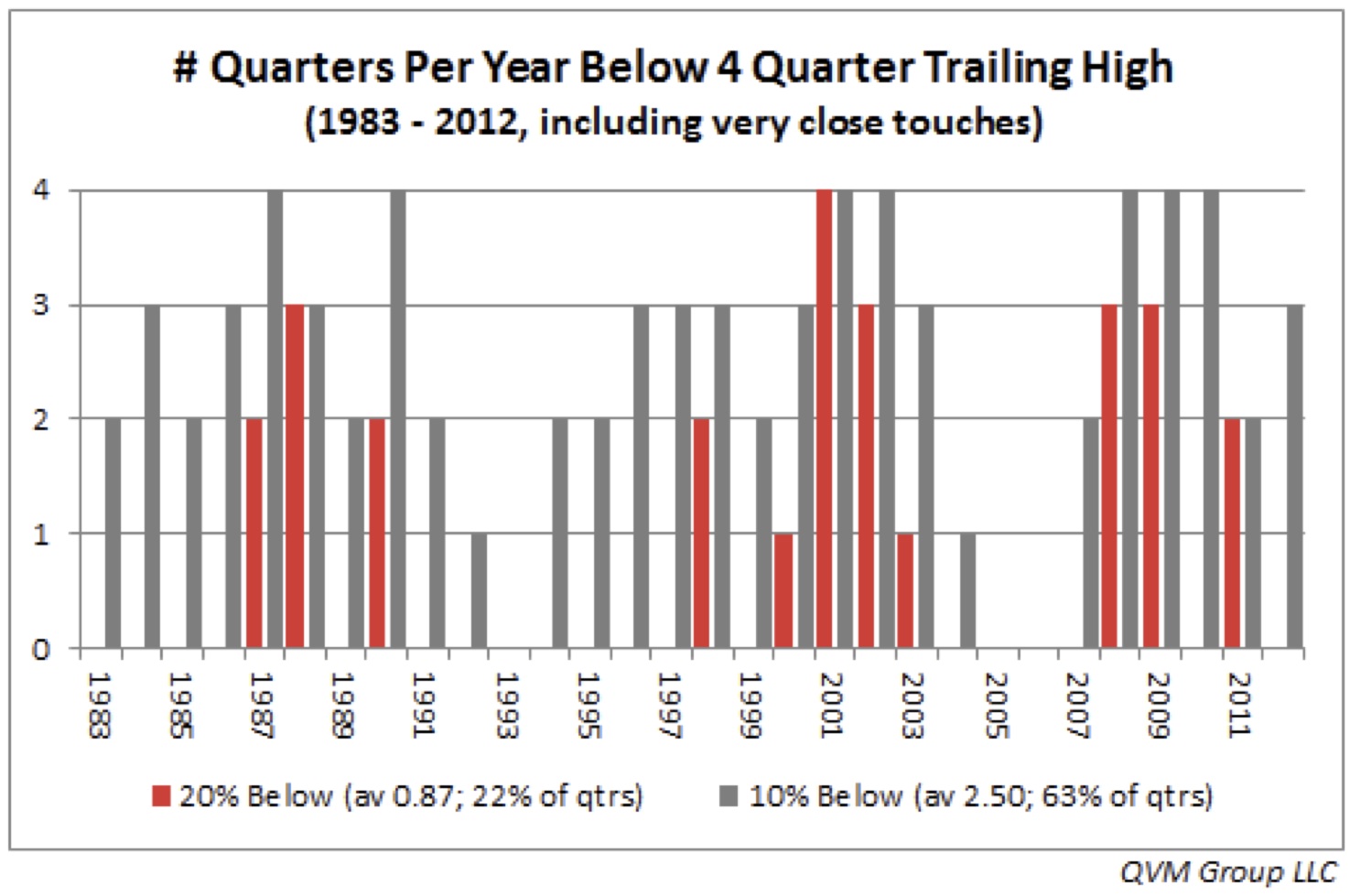

4/8/14 Chart of the Week: Market Volatility

In this week's Chart of the Week, we discuss increased volatility, how often it occurs, and what it means to investors.

4/1/14 Chart of the Week: Valuation Dispersion

In 2000, the market’s PE ratio was nearly double that of 2014. Ironically, there are less companies for sale today at valuations we are comfortable with. Learn more in this Chart of the Week with Pilot's portfolio manager, Nick Fisher.

3/25/14 Chart of the Week: Anatomy of a Bubble

Bubbles have predictable patterns: human emotions can drive asset prices to irrational levels. Understanding this can hopefully help us avoid following the lemmings off a cliff.