Having a small farm outside Sherwood and being someone interested in cultivating my green thumb, we planted a few pinot noir vines last year.

In the vineyard, vintners are often at the mercy of the climate and weather. The delicate, thin skinned, Pinot Noir grape, for example, needs a minimum number of growing degree days, but not too much, as raisins make for poor quality wine.

The result of all this science is to compare vintages, for example the 2008 oregon pinot noir vintage is considered outstanding, primarily because of the exceptional cool growing season and dry harvest. To expect a 2008 vintage and a dissimilar 2009 vintage to yield the same value would be foolish. Both the climate (i.e., location of the vineyard), but also the weather in an individual vineyard, are crucial. So it is with investments.

It's not what you don't know that kills you; it's what you know for sure that ain't true. -Mark Twain

To compare this recession to any recession, other than debt deflationary recessions (ie. 1870's, 1930's in the US, 1990's in Japan) is also foolish. Comparing interest rates, and stock prices to trends of the last 20 or 30 years is unwise. This is corroborated and evident in the data. Economic growth has been abnormally sluggish compared to anything but those time periods. Interest rates are ridiculously low and the equity risk premiums are attractive...unless you compare them to a similar vintage.

We are still in the midst of a debt-deflation cycle. In this cycle, consumer, corporate and government sectors are forced to deleverage from unusually high debt levels. The first half of the cycle may be nearing completion, with corporations and consumers having normalized their debt levels.

householddebt1

Deleveraging in the government remains. Unfortunately, the Federal Reserve has the very delicate job of combining growth and inflation to normalize the debt levels. Interest rates are going to play a key role and the recent increase we have seen will not help us out.

The Federal Reserve's Quantitative Easing (QE) program has been manipulating the market to achieve stability. Reportedly, as much as 85% of stock movements over the last couple years have been attributed to QE, rather than earnings growth. As the Fed now contemplates how to taper off their bond purchases, the market has responded with nervousness. Pimco's Mohamed El-Erian has labeled this current state "stable disequilibrium." With stagnant economic growth, deleveraging on the government side may take longer than the Fed hopes. Of course the Fed's economists have optimistically predicted stronger growth every year than what has materialized. We seem to be putting a whole lot of faith in the economists at the Fed. It is no wonder why investors are beginning to lose faith.

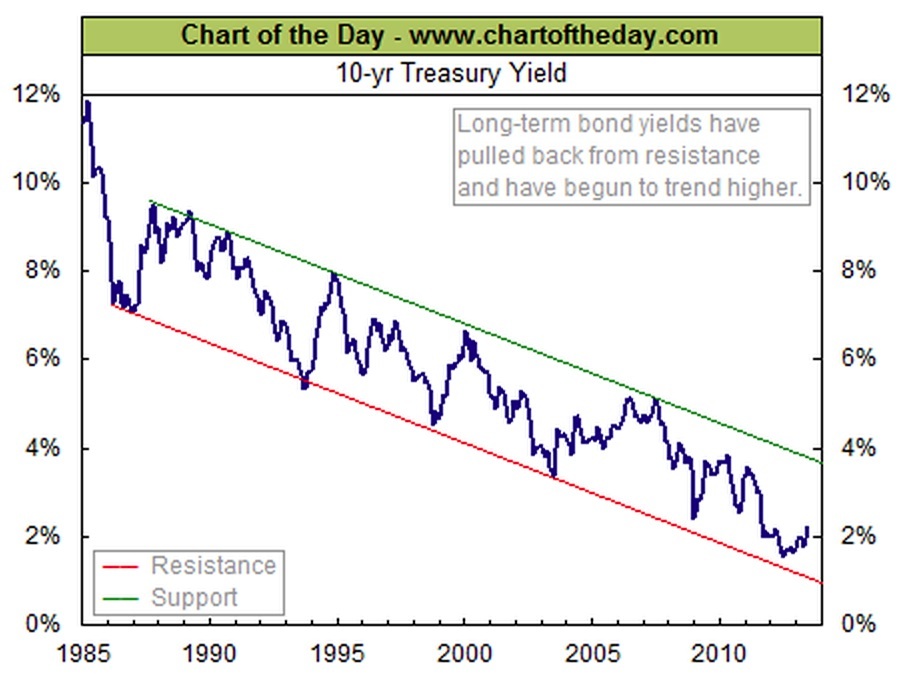

Interest Rates We certainly may have seen the lows in the bond market, but technically speaking we have not broken the trend line yet. According to Crestmont Research, the interest rate move we have seen is not uncommon. In fact, 98.5% of the time, over a 6 month period interest rates at some point along the yield curve will move 50 basis point (0.5%). We have heard many economists, advisors and investors suggest that the 30 year bull market in interest rates has come to an end and interest rates are bound to rise precipitously. I don't think they are considering the repercussions of this idea.

10yrtyield

Undoubtedly interest rates will eventually rise, but when interest rates rise, so does the debt service on the now massive national debt. The congressional budget office (CBO) has stated in their Budget and Economic Outlook (released early this year) that they expect interest rates on the 10 year Treasury bond to rise to 5.2% by 2017. With an average debt maturity around 60 months, the treasury will be forced to refinance the national debt at rates much higher than the current levels. Not including future deficit spending, the debt service on our current nearly $17 trillion in debt will begin to approach $1 trillion dollars. That is in debt service alone and does not include the nearly trillion dollars of expected government spending outside of interest payments. Furthermore, it assumes we are able to forgo a recession in the meantime. Perhaps we should remain skeptical of the economists' ability at the Federal Reserve; after all they have failed to accurately project any of the recent economic maladies we have faced. Needless to say, I expect the Federal Reserve to attempt to keep interest rates in a trading range for quite some time.

Investment Themes Our investment themes discussed at the beginning of the year: Large Cap technology has underperformed thus far Financials: Regional banks are performing very well, but investment banking has been slow Home construction has returned, and related stocks have performed very well Natural Gas is still too cheap Cloud computing and social networking stocks are still overvalued

Emerging market stocks have been a terrible place to be invested recently and we have been underweight for quite some time. As expectations for economic growth in China have plummeted, so have expectations in other emerging markets. As promised we have begun to increase our weighting to more of an "equal weight" from an under weighting.

We expect slow growth economically and plenty of opportunity created through volatility in the coming months.